Natural Capital, Biodiversity and TNFD Report 2024

We are pleased to share our latest report which examines how Quinbrook incorporates natural capital into its investment and asset management strategies. The infrastructure asset class provides key opportunities to support growth of this sector, while seeking to capture further benefits through mechanisms such as the U.K.’s Biodiversity Net Gain (BNG) legislation. Quinbrook is an Early Adopter of the Taskforce on Nature-related Financial Disclosures (TNFD) and our inaugural report is also included, demonstrating how we seek to better invest in, assess and report on biodiversity. Read our report here

Climate Impact and Opportunities Report

We are proud to share our latest Climate Opportunity and Risk report with you, which outlines our approach to investing in the energy transition, driving impact through additionality and growth investments, and actively managing portfolio strategies and risks.

Our Awards

ESG Investing Awards 2021

Investment Fund of the Year

ESG Investing Awards 2021

Winner Best ESG Investment Fund:

Energy Transition

ESG Investing Awards 2021

Winner Best ESG Investment Fund:

Infrastructure

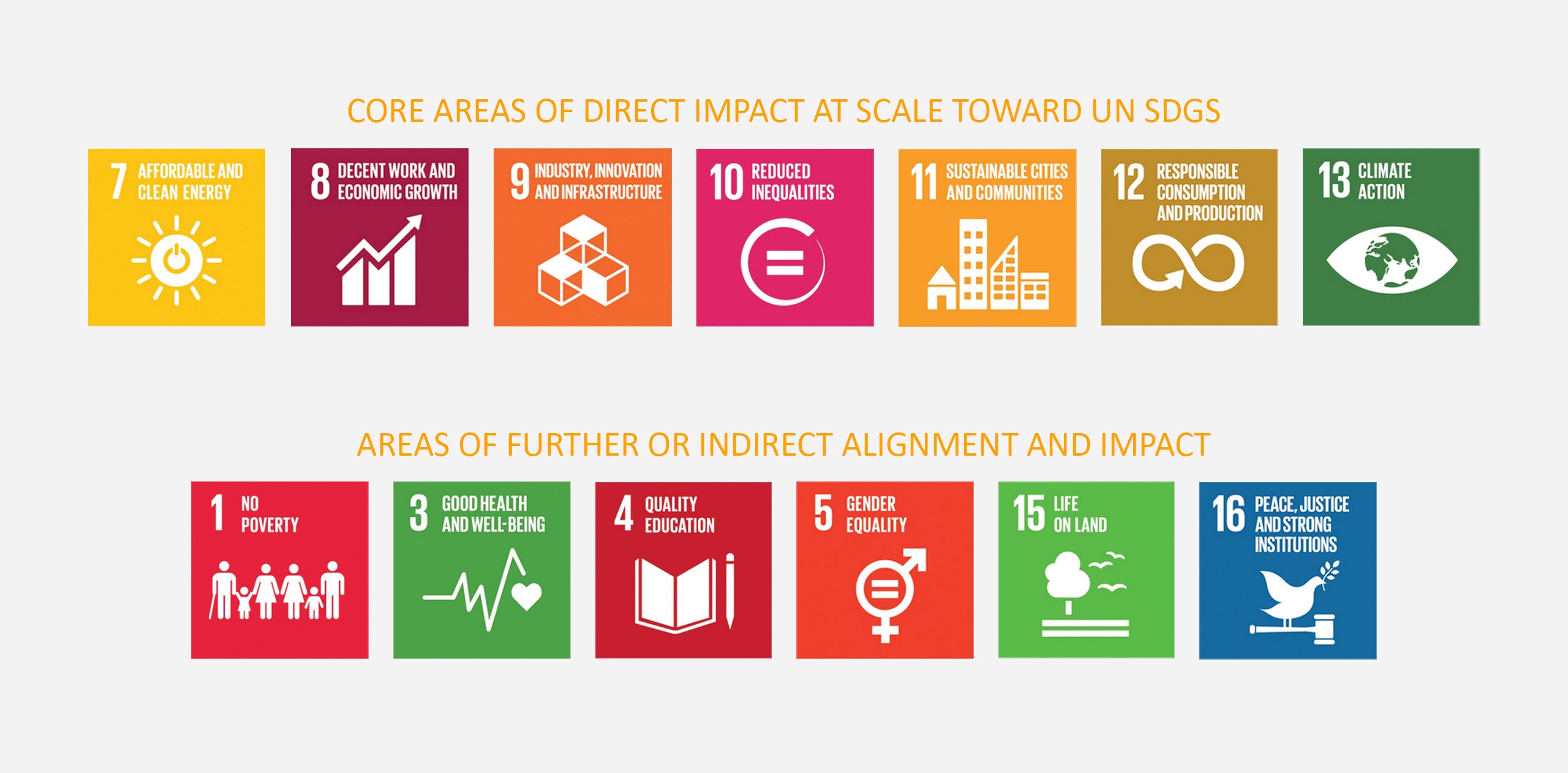

Driving Opportunity and ‘Best Practice’ Stewardship and Risk Management

As an investor and manager of low-carbon and renewable infrastructure and businesses, our primary mission is inherently aligned with achieving ambitious industrial and climate goals. Our commitment to sustainability, ethics, and responsible stewardship extends to our diverse stakeholder community and the numerous communities where our ventures operate.

We are acutely aware of the far-reaching impact our portfolio companies have on society. Through growth and new build investments, we can create and preserve jobs, enhance business transparency and governance, foster community engagement, promote team diversity, cultivate a corporate culture rooted in integrity and ethics, and seek to drive sustainable opportunities across Quinbrook’s managed portfolios.

Quinbrook firmly believes that our specialised focus on investments that facilitate the creation of new assets and businesses supporting a sustainable, equitable energy future positions us to safeguard and enrich the value of all forms of capital—human, environmental, and financial—for our investors and society at large.

UN PRI Assessment 2023

The UN PRI is the world’s leading reporting project on responsible investment and annually evaluates investors’ integration of climate, sustainability, social impact and responsibility into investment practice.

Quinbrook is delighted to have received the following scores in its 2023 Assessment across all its assessed categories:

- Policy Governance and Strategy: 98%, ★★★★★

- Direct – Infrastructure: 100%, ★★★★★

- Confidence building measures: 100%, ★★★★★

The median score for Policy Governance and Strategy was 60%, the median for Direct Infrastructure was 79%, and the median for Confidence building measures was 80%.

These results highlight Quinbrook’s rigorous integration of ESG into its active investment and management decision-making, and its ongoing commitment to investing responsibly to build a cleaner, more resilient energy landscape.

Quinbrook’s full Assessment and Transparency reports from the UN PRI are available to download.

Environmental stewardship

Climate and emissions reduction are central to Quinbrook’s purpose and investment thesis, and to meeting the 2015 Paris Agreement commitments to “holding the increase in the global average temperature to below 2°C above pre-industrial levels”. Renewable energy also has a much broader responsibility to minimize environmental harm and we endeavour to support the environments in which our assets reside. Initiatives have included the creation of co-located pollinator habitats, supporting local farmers; recycling and reuse of assets such as batteries and solar panels to minimize life cycle footprint; stopping use of native timber and food sources land for biomass; and understanding water stress and minimizing water use through better design, such as data centers with recycled water supply.

Jobs, community impact and supporting local economic recovery

Job creation, job displacement and retraining, community health and wellbeing, human rights and modern slavery are all central considerations in the growth of long-term infrastructure development. By investing in new build assets, Quinbrook is able to create new jobs, support areas that may have suffered job displacement and can drive better environmental justice, provide better affordability, security and reliability of energy and work with communities who are most vulnerable to the impacts of climate change. Beyond our impact on our immediate communities, Quinbrook is focused on our supply chains, seeking to use our influence to cease modern slavery, a complex issue across many industries and regions today.

Active management, alignment and improved governance

Through active governance control, continuous engagement with our investee business management teams and consistently applied investment processes, we seek to achieve enduring alignment in the pursuit of positive climate, environmental, social and governance impacts from our investing activities. We believe that the integration of responsible investment and impact practices and commitments into our own investment processes and ongoing asset management is fundamental to both long-term value creation and value protection. This commitment equips us to anticipate, plan for and avoid certain risks whilst also identifying opportunities to create lasting value through improved resilience of essential infrastructure and related businesses. Through investee board representation Quinbrook is able drive more robust governance measures and implement key initiatives to drive broader climate, sustainability and impact goals.

Investor login

Investor login