Quinbrook History

Quinbrook was established in July 2015 by David Scaysbrook and Rory Quinlan (the “Founders”) who have invested in renewables for over two decades and in power infrastructure more broadly since the early 1990s. As fund managers, they have led investment teams and portfolio companies that have invested over USD 2.5 billion of equity in over 200 low carbon, renewable, storage and grid support projects covering a wide spectrum of technologies.

Specialist Investor and Operator

We bring disciplined management of risk and return to each of the origination, development, and construction risk stages of infrastructure asset creation. In particular, we build with a view to achieving platform scale, we target markets where we see an early mover advantage, and we manage our operate our assets to deliver holistic and tangible impacts.

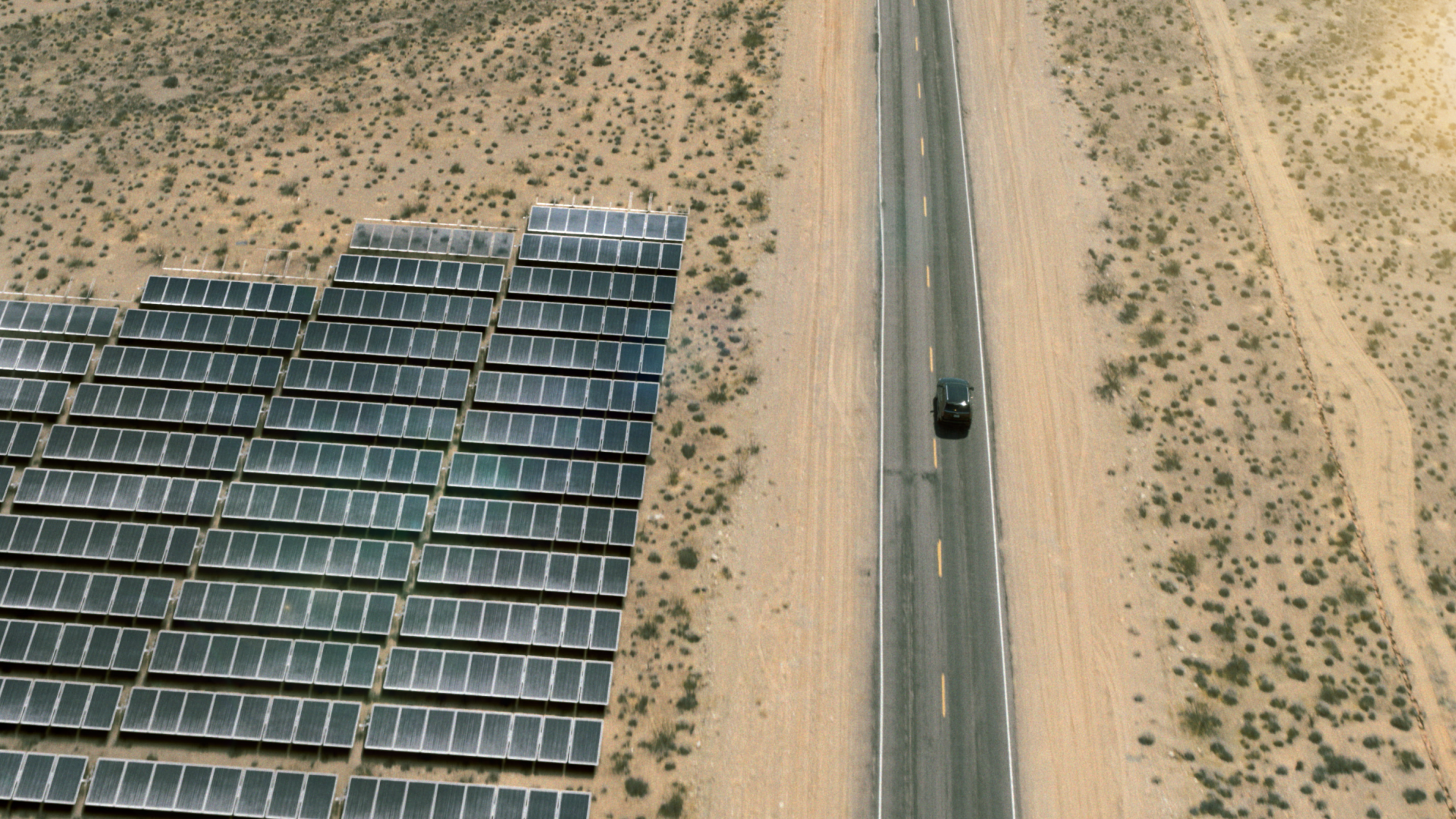

Furthering the Energy Transition

Quinbrook strives to operate at the forefront of the unprecedented and accelerating energy transition. Through a number of industry leading investments and initiatives, we are helping to directly support the parallel achievement of impact and net zero emissions targets across the US, UK and Australia.

Investor login

Investor login